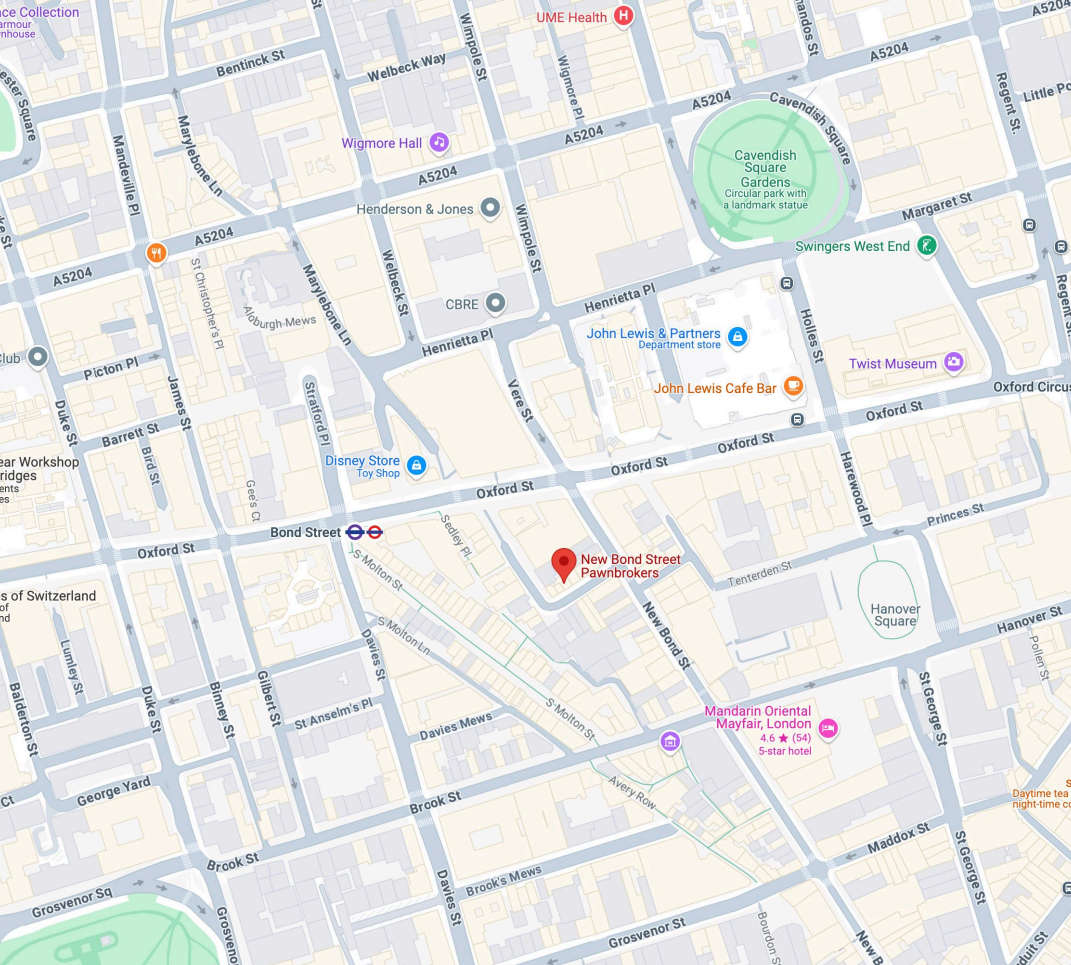

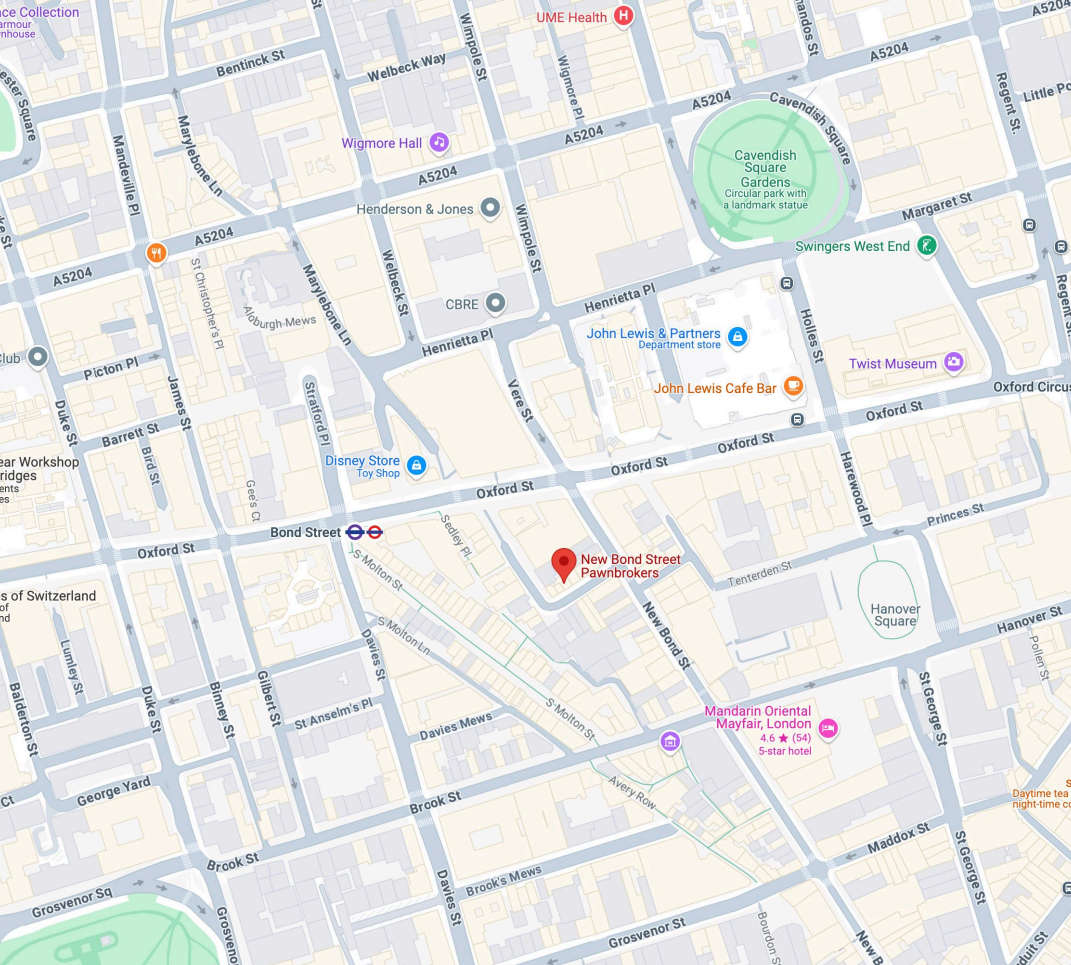

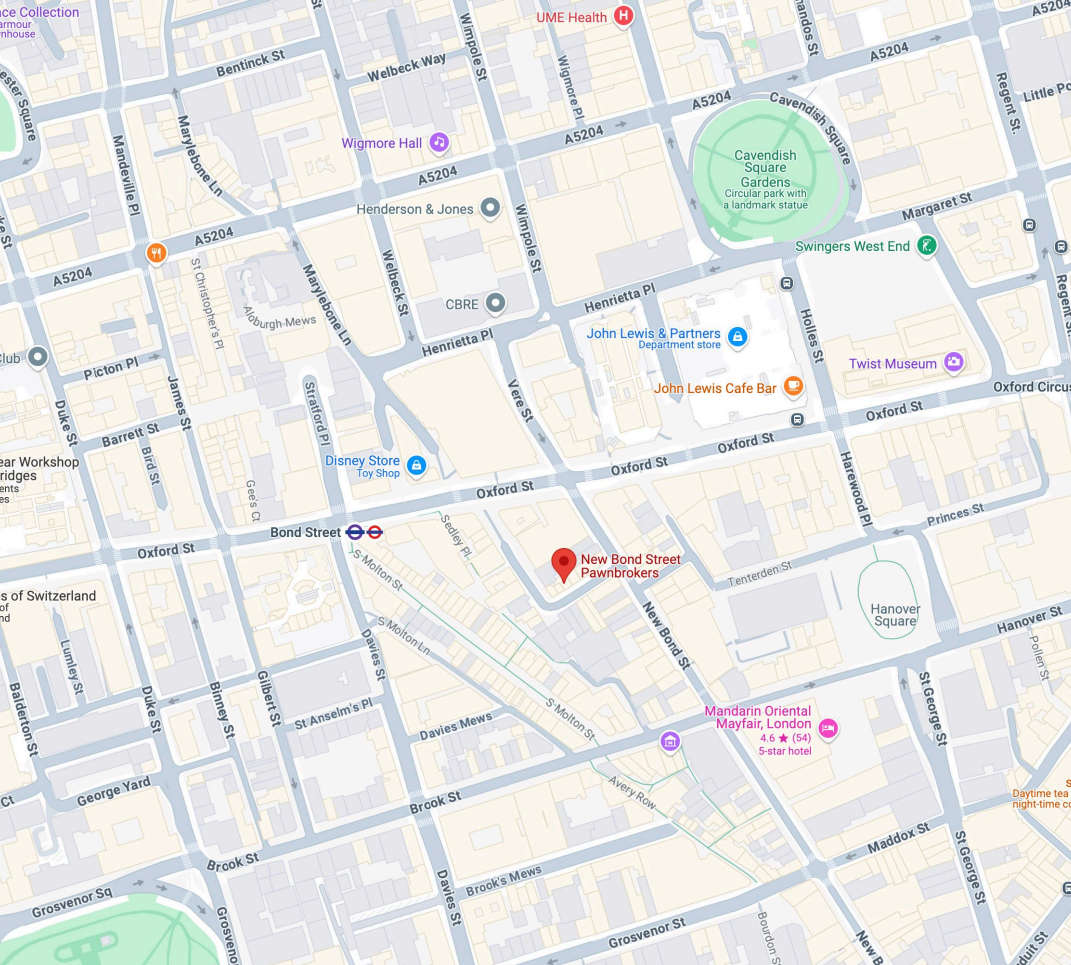

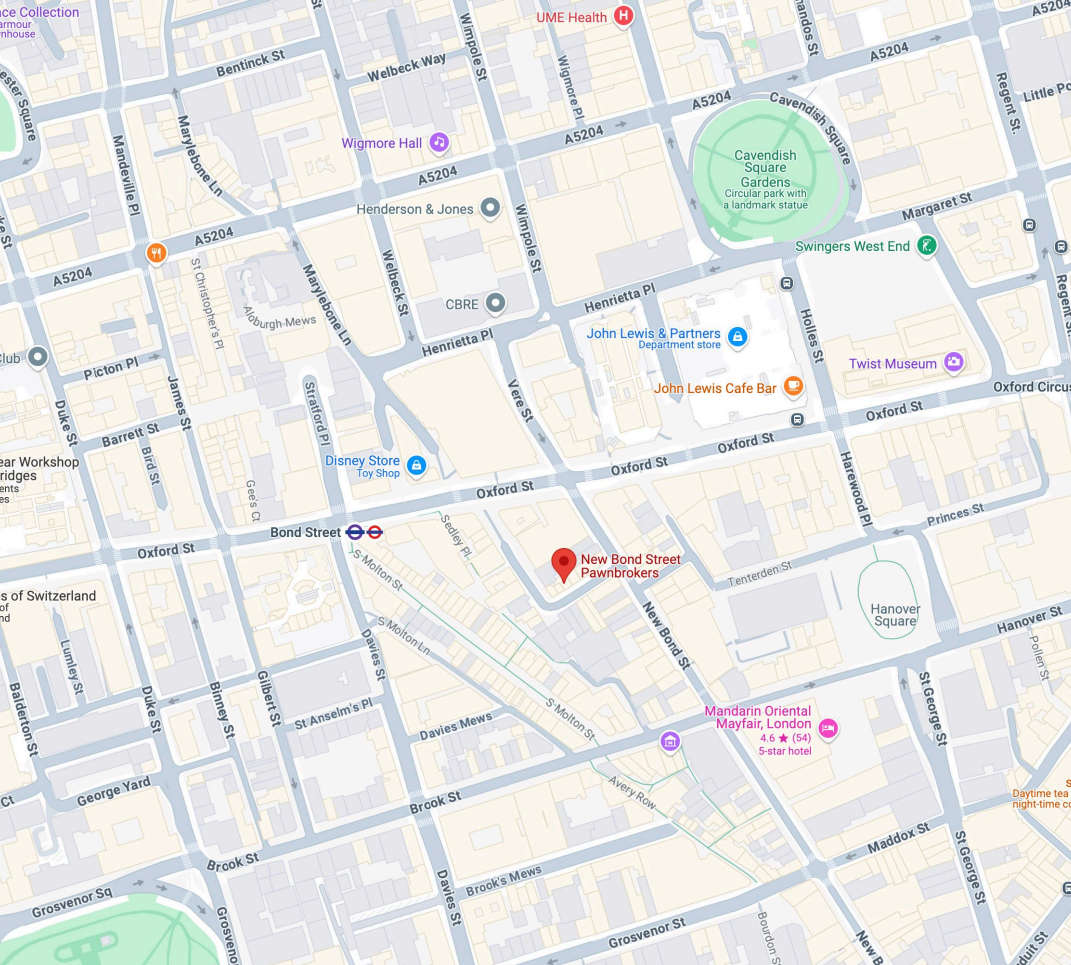

Our premises are at 5 Blenheim Street, just off New Bond Street. From Oxford Street, head south on New Bond Street and turn right onto Blenheim Street. We’re on the left side of the street.

Pawn Your Fine Jewellery

Fine Jewellery we loan against

5%

fixed interest rate

35+

years experience

40+

industry awards

Regulated by the FCA

Our promise to you

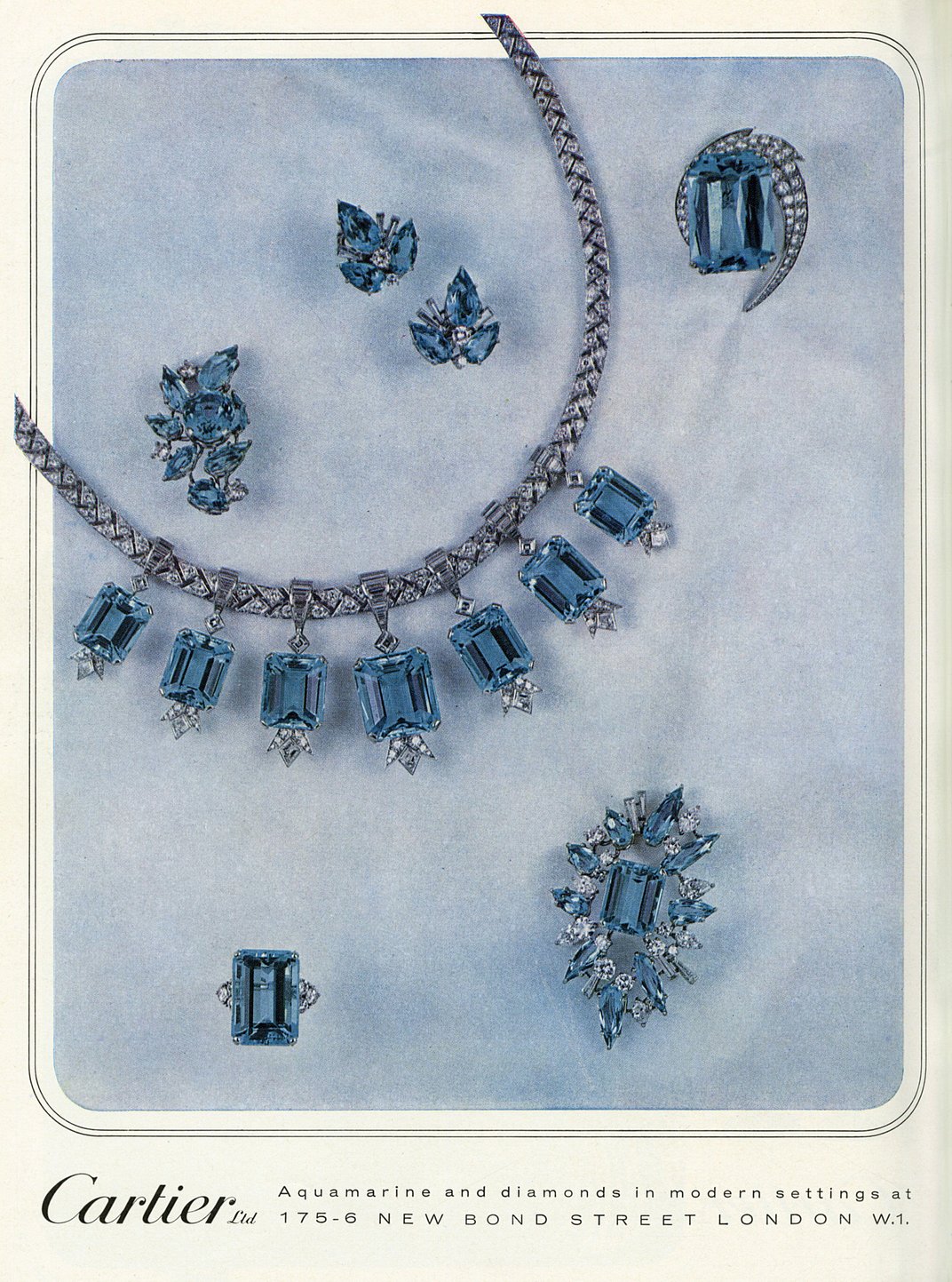

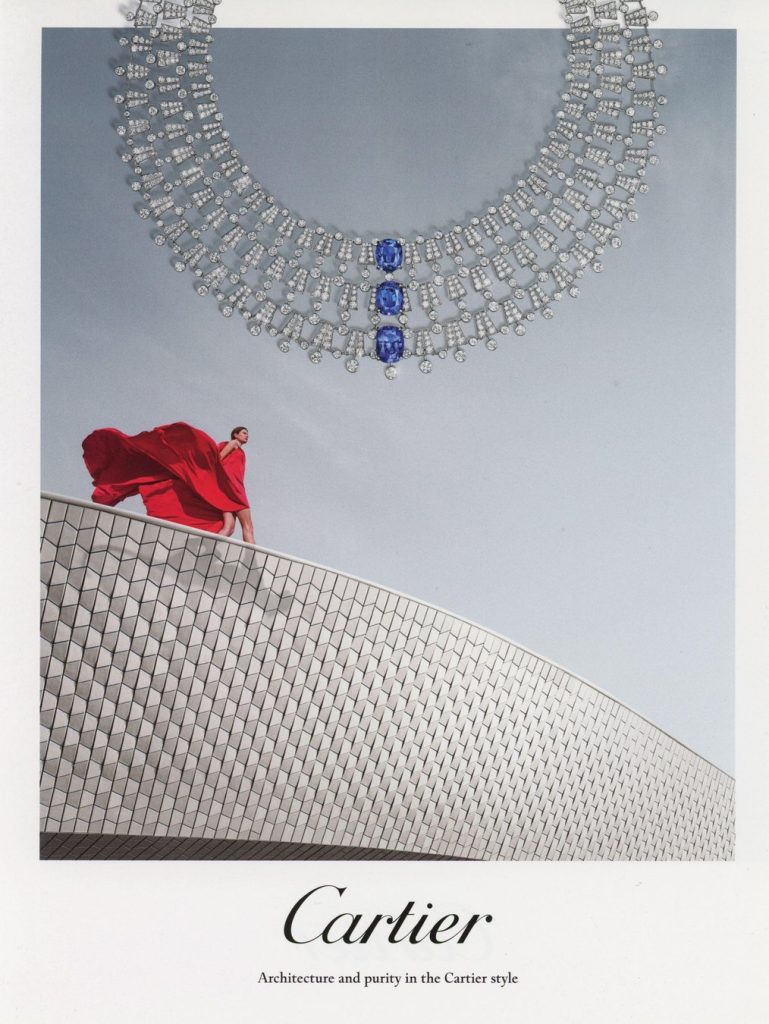

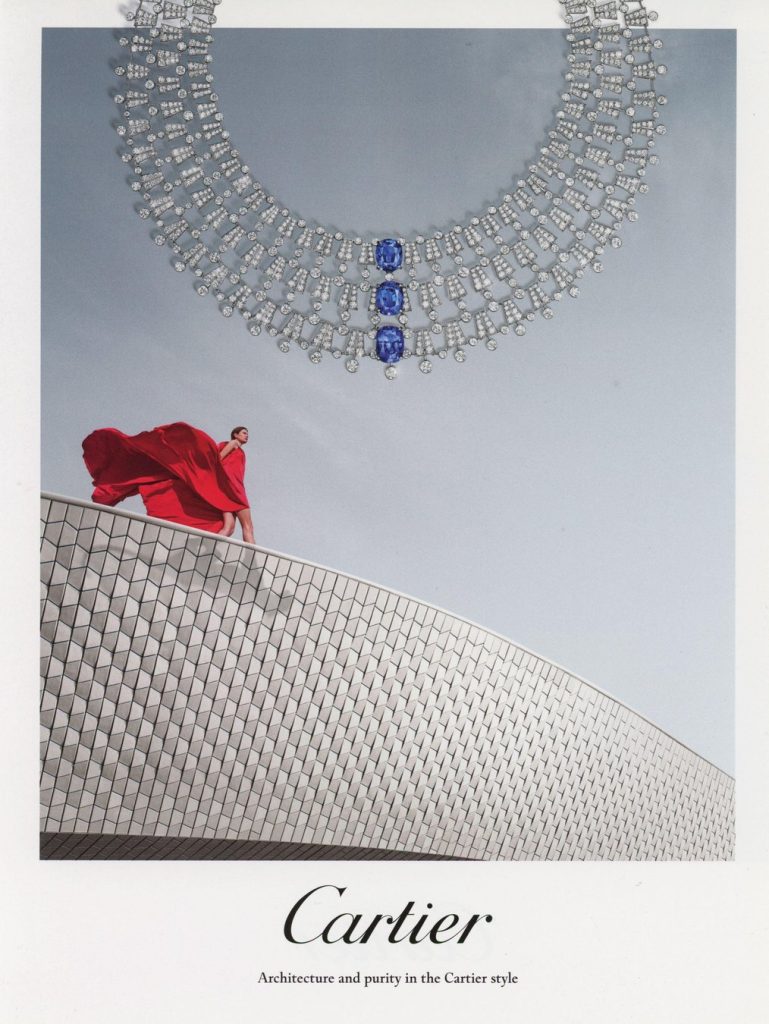

When you pawn fine jewellery with New Bond Street Pawnbrokers in Mayfair, we guarantee a competitive 5% fixed interest rate. This transparent pricing ensures your jewellery collateral loans remain predictable when you’re leveraging high-end designer pieces from brands like Cartier, Tiffany & Co., Bulgari, and more.

Our Central London experts provide precise, auction-based jewellery valuations. This approach ensures you receive a fair offer when you pawn expensive jewellery, reflecting current market trends and the unique qualities of your Van Cleef & Arpels, Chopard, Graff, or Harry Winston pieces.

At our pawn shop near Oxford Street, transparency is baked into our process. We pride ourselves on clear, upfront pricing for jewellery loans. There are no surprises or hidden charges when you borrow against designer jewellery —just honest, straightforward transactions that you can count on.

We don’t require credit checks when providing jewellery loans in London. This policy ensures swift, discreet financing for all clients, regardless of credit history. Our Mayfair location offers accessibility and privacy when you pawn Pawn Cartier, Graff, Van Cleef & Arpels, and other treasured fine jewellery.

Our Central London pawnbrokers offer same-day payments, with many transactions completed within two hours. Located conveniently near Bond Street Station, we provide rapid solutions for loans using high-end jewellery as collateral, ensuring our customers have a quick and credible alternative to traditional unsecured loans.

Flexibility is essential when you pawn expensive jewellery. When you work with New Bond Street Pawnbrokers, you can repay your loan at any time during the contract term without incurring an early termination penalty, ensuring you can manage your jewellery loan on your schedule.

As FCA-regulated pawnbrokers and members of the NPA, we ensure your fine jewellery loan adheres to the highest standards. When you pawn jewellery at our Central London shop, you’re guaranteed a fair, transparent, and secure transaction that works in your favour and allows you to retain ownership of your treasured adornments.

The most awarded pawnbroker in the UK

With over 40 prestigious industry awards, a loyal customer base, and flawless reviews, our track record speaks for itself. We retain a customer base of high-net-worth individuals and famous names through competitive interest rates, discretion, trust, and impeccable service.

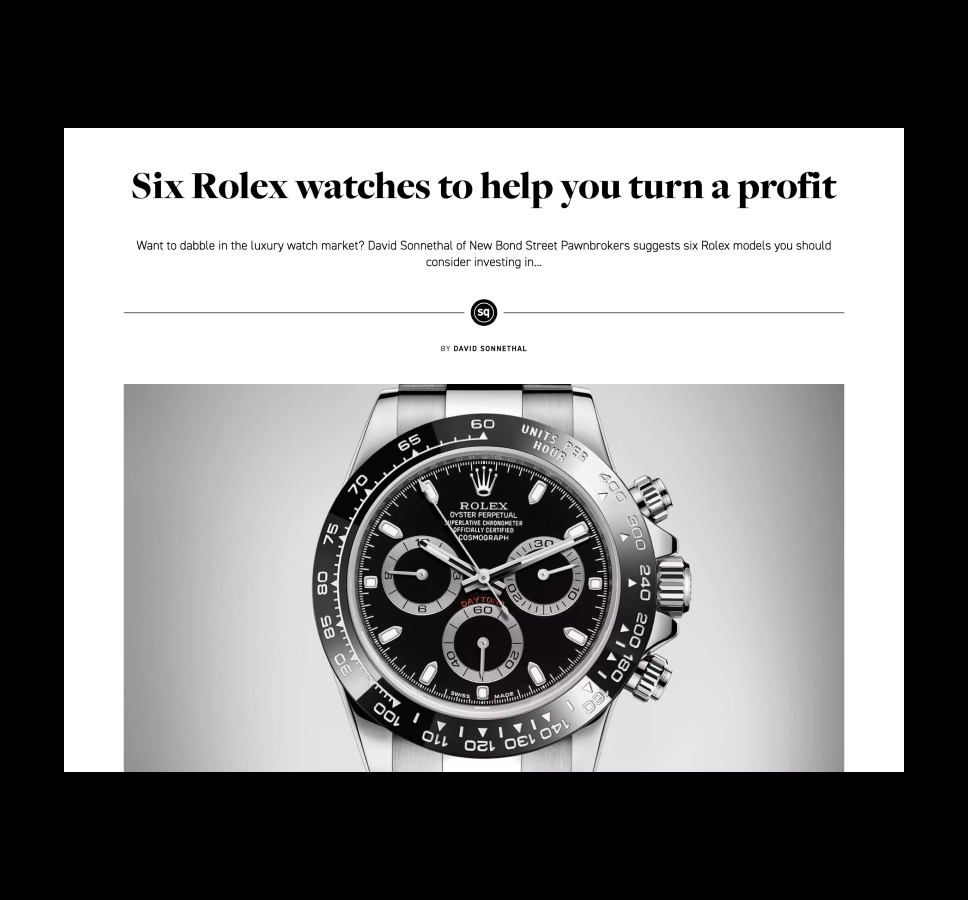

Headed by David Sonnethal, a four-time National Pawnbroker Association (NPA) award winner and familiar media figure, New Bond Street Pawnbrokers’ modern, forward-thinking approach to providing loans has not gone unnoticed by the public, the media, or trusted industry bodies.

Our reputation as an industry leader is cemented by awards that recognise the value that our store brings to customers. We took home the NPA Best Store of the Year award in 2019 and 2024 thanks to our commitment to innovation, adoption of technology, and a strong focus on teamwork. Additionally, the NPA highly commended us in 2022 and 2023 for our engaging social media work, which helped bring us closer to our customers.

New Bond Street Pawnbrokers also won “Best Website” and “Disruptive Business Model” at the UK Business Awards, thanks to our focus on customer-centric digital experiences. Finally, our win at the Experian Credit Awards demonstrates our dedication to responsible lending, customer care, and digital innovation in the luxury pawnbroking sector.

Transparency, fair lending practices, and user-friendly experiences are at the heart of what we do at New Bond Street Pawnbrokers. Reach out today to discover why we’re the most awarded pawn shop in the UK.

Common brands we loan against

Transparency and integrity are at the core of our business model. We offer competitive fixed monthly rates and flexible loan terms on luxury jewellery and diamonds, with no hidden fees or charges. Our contracts are regulated by the Financial Conduct Authority, providing our clients with peace of mind and protection.

How we value your fine jewellery

Call us or fill in the form on our website

Contact us through our website or visit our pawn shop near Oxford Street Station. Provide relevant details about your luxury pieces, including brand and materials. Our jewellery pawnbrokers specialise in loans against designer jewellery from brands like Cartier, Graff, and Van Cleef & Arpels.

Or call 020 7493 0385 to speak with our team

2. Review Fine Jewellery

Our experts examine your fine jewellery at our Central London location, assessing brand reputation, craftsmanship, materials, and current market dynamics. Using auction-based jewellery valuations, we ensure an accurate appraisal of your Cartier, Graff, or other luxury pieces.

3. Agree Loan Amount

Our loan offer reflects your jewellery’s brand, craftsmanship, and gemstones. We make you a loan offer in accordance with FCA regulations. Once you understand the terms, we will sign off on the deal.

4. Receive Payment

Upon agreement, you receive instant payment via bank transfer, often within about two hours. We keep your fine jewellery securely stored in our West End vaults and allow you to pay off your loan at any time, without early termination fees.

Featured in the Press

Our quality service, high standards, and innovative business practices have earned positive press coverage from a diverse set of media outlets such as The Times, The Telegraph, Time Out, Channel 4, The Spectator, and more.

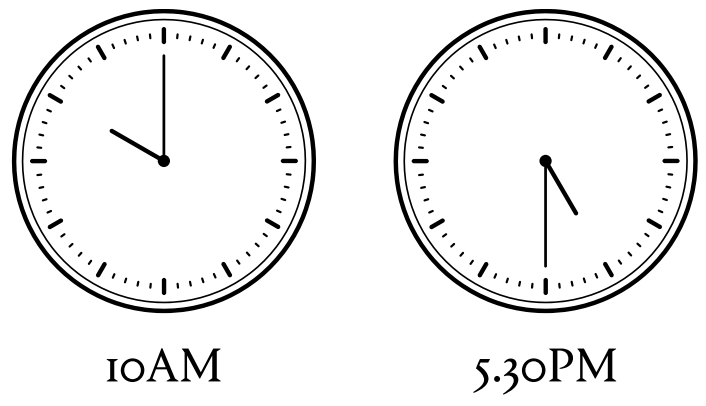

Opening Hours

Open

Monday to Friday

Closed

Saturday & Sunday

Bus

Car

Tube

Our Team

Susana Figueiredo

Manages the day to day running of the business

Mariana Vlad

Manages the day to day running of the business

Constantin Singureanu

Heads up our marketing and digital efforts

David Sonnenthal

The founder of New Bond Street Pawnbrokers

FAQs

How does pawning fine jewellery compare to selling it?

Pawning your fine jewellery with New Bond Street Pawnbrokers in Mayfair, London offers several advantages over selling. You retain ownership of your cherished pieces while accessing quick funds. Our auction-based jewellery valuations ensure you receive a fair loan amount, and you can reclaim your items once the loan is repaid.

What brands of jewellery do you lend against?

As luxury jewellery pawnbrokers, we offer loans against prestigious brands, including Cartier, Graff, Van Cleef & Arpels, Bulgari, Tiffany & Co., and other high-end designers. Our expertise in designer jewellery allows us to provide competitive loan offers.

What types of diamond jewellery do you loan against?

We provide jewellery loans in London for a wide range of diamond pieces, including bracelets, necklaces, engagement rings, wedding rings, and other fine jewellery items.

How do you value diamond jewellery for loans?

Our expert appraisers consider factors such as carat weight, cut, clarity, colour, and brand reputation. We use auction-based jewellery valuations to ensure you receive the most accurate and fair assessment.

How much can I borrow against my jewellery?

Loan amounts vary based on the value of your fine jewellery. At our Mayfair location, we strive to offer the maximum possible loan value for your pieces.

Are there penalties for early repayment?

No, we don’t charge penalties for early repayment. You’re welcome to redeem your jewellery at any time during the loan term.

What's the typical loan duration for jewellery?

Our standard loan term is up to 7 months, but this can be flexible based on your needs.

What happens if I can't repay my loan?

If you cannot repay, we may need to sell your jewellery to recover the loan amount. However, we always try to work with clients to find alternative solutions first.

What documentation do I need to pawn my diamond jewellery?

Bring any certificates of authenticity, original receipts, or appraisal documents you have. While not always necessary, these can help maximise your loan value.

Can you provide an example of a jewellery loan?

Recently, we provided a £50,000 loan against a Cartier diamond necklace valued at £100,000, demonstrating our ability to offer substantial jewellery collateral loans.

Can I renew my loan agreement?

Yes, loan renewals are possible, subject to interest payment and reappraisal.

Do you perform credit checks?

No, we don’t require credit checks because your jewellery is collateral.

Can I pawn found jewellery?

For legal reasons, we cannot accept found jewellery. We only deal with pieces you can prove ownership of.

Do you accept damaged jewellery?

We may consider damaged pieces, but their condition will understandably affect the loan value. Our experts can assess damaged items from our New Bond Street location.

How do you authenticate jewellery?

Our appraisers use their experience and various advanced techniques to spot fake jewellery, ensuring we only lend against genuine pieces.

Useful Guides

How to get the best price when Pawning your Classic Car

You may have heard the phrase that something is only worth what someone is willing to pay for it. In…

Top 8 Brands of Classic Cars You Can Loan Against at Luxury Pawn Shops

1. ASTON MARTIN Lionel Martin and Robert Bamford are to be thanked for the founding of Aston Martin, way back…

How to get the best price when Pawning your Classic Car

You may have heard the phrase that something is only worth what someone is willing to pay for it. In…

Top 8 Brands of Classic Cars You Can Loan Against at Luxury Pawn Shops

1. ASTON MARTIN Lionel Martin and Robert Bamford are to be thanked for the founding of Aston Martin, way back…