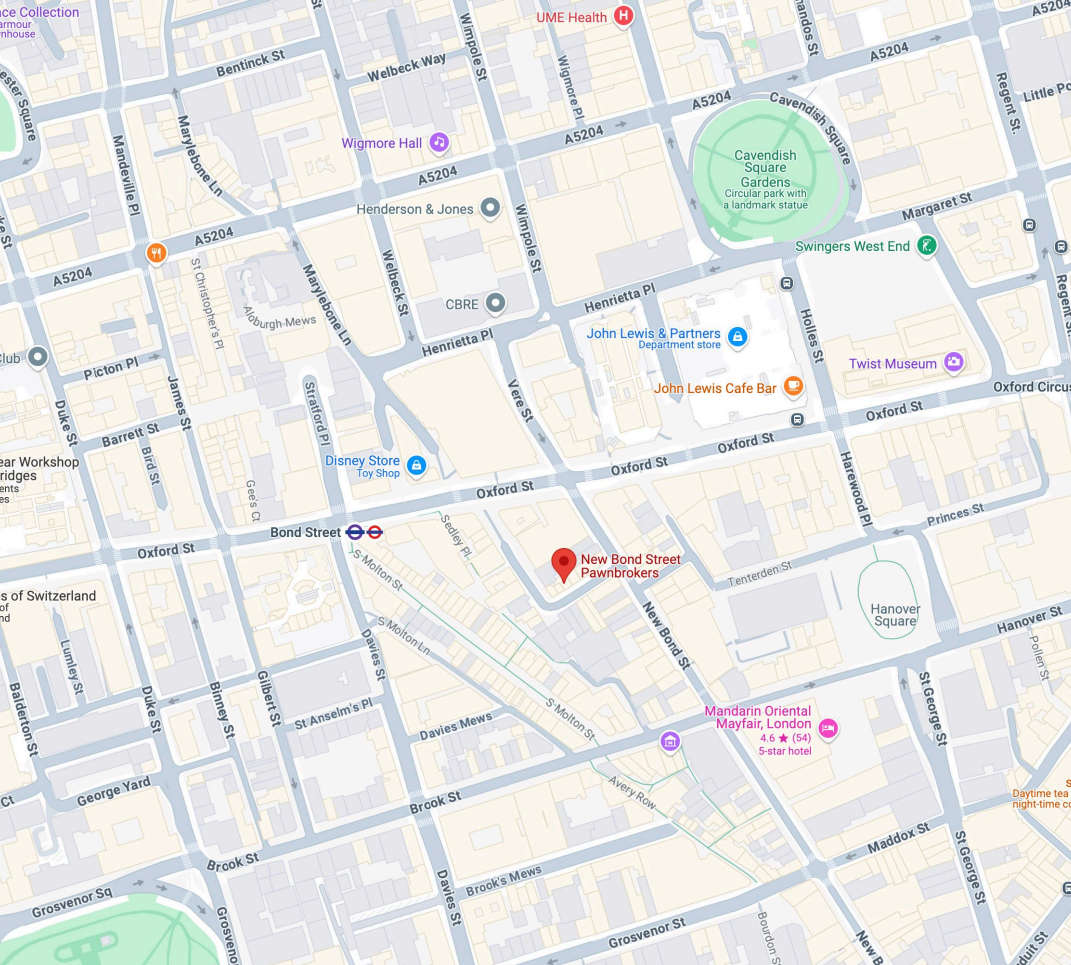

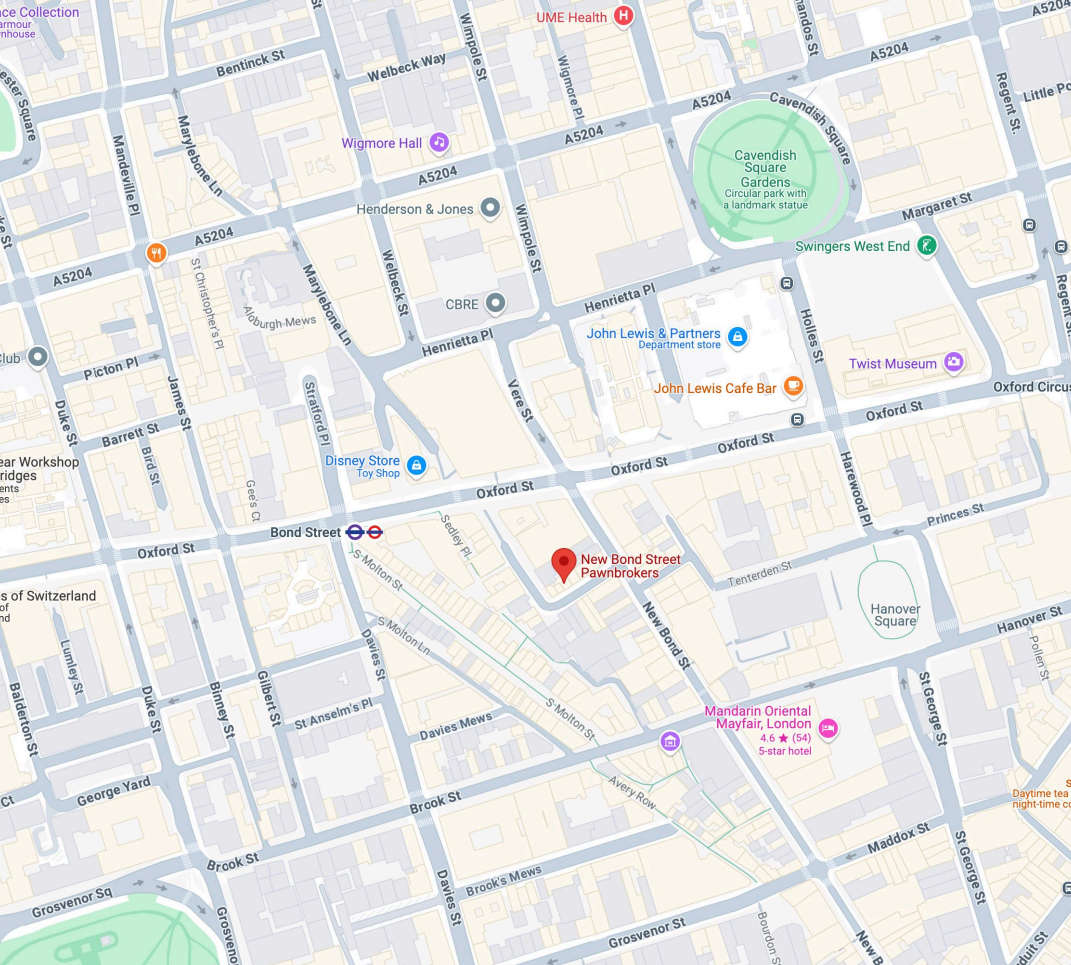

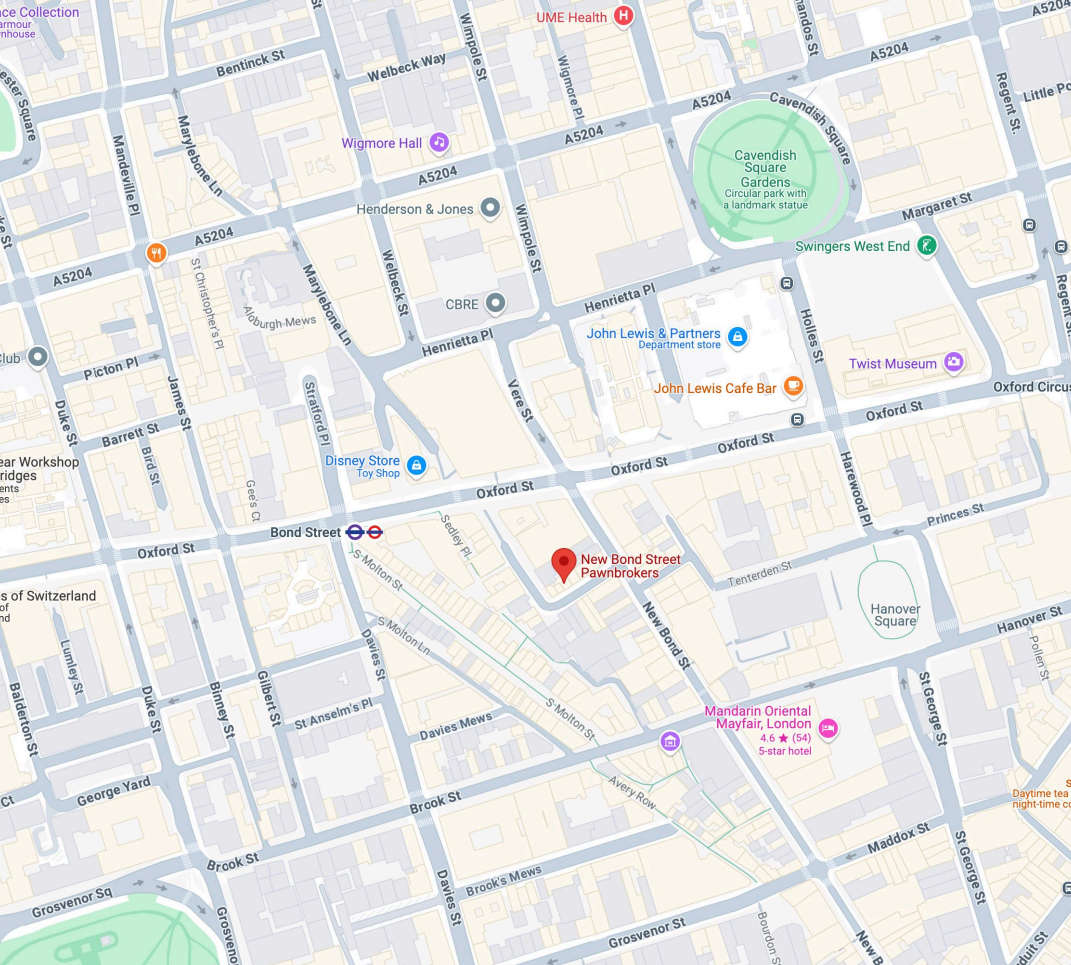

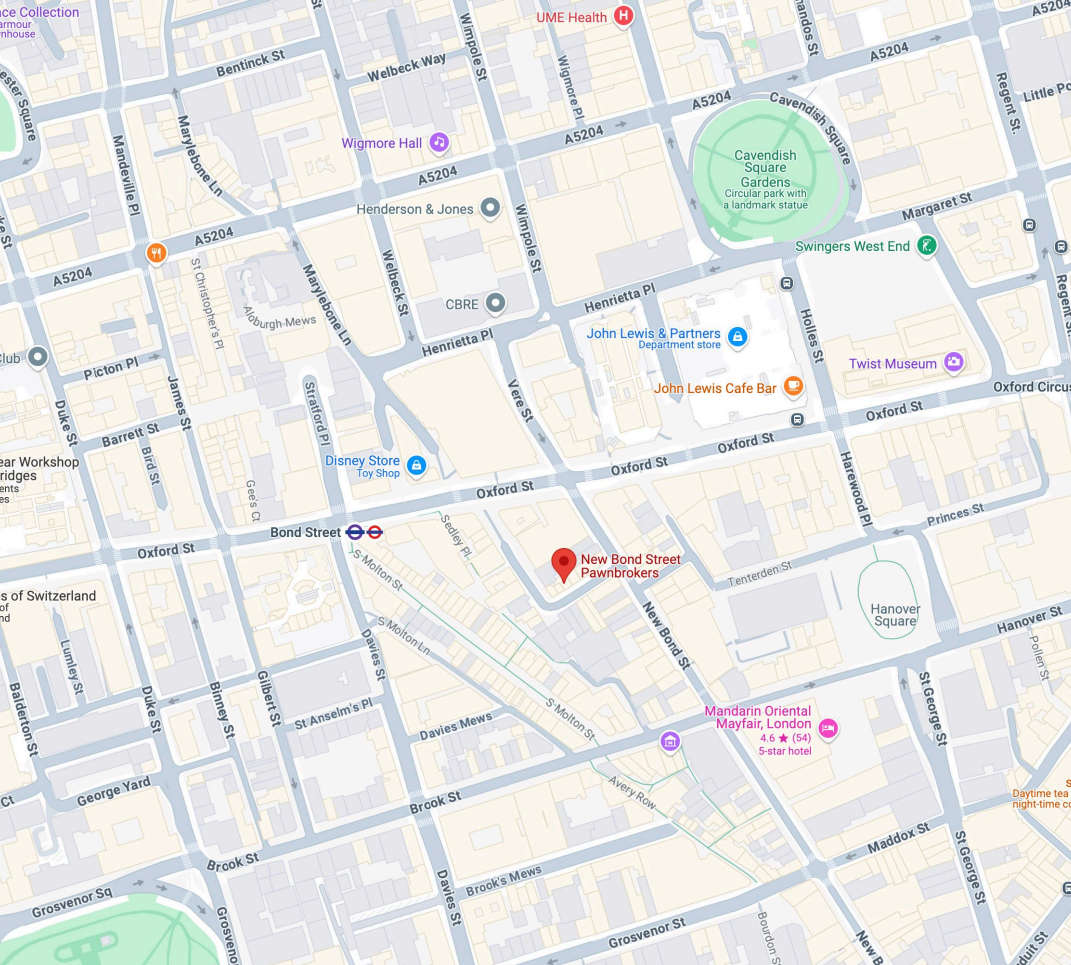

Our premises are at 5 Blenheim Street, just off New Bond Street. From Oxford Street, head south on New Bond Street and turn right onto Blenheim Street. We’re on the left side of the street.

Pawn Your GIA Certified Diamonds

Our promise to you

Borrow against certified diamonds at our pawn shop, we offer a competitive 5% fixed interest rate. This ensures your diamond financing remains predictable and manageable, allowing you to plan your budget with confidence while leveraging your GIA-certified gems. In a world of uncertainty, our loans stand out.

Our expert appraisers and esteemed experts use their experience and auction data to provide precise valuations for your GIA diamonds. Our complimentary four Cs diamond valuation ensures you receive a fair and competitive offer when you pawn loose diamonds, reflecting amounts that reflect their true market value and quality certification.

Transparency is key when you’re evaluating any pawn shop for diamonds. We pride ourselves on clear, upfront pricing with no surprises. All costs associated with your diamond financing are disclosed from the start, ensuring a straightforward and honest transaction on your short-term luxury asset loan.

Our diamond loans in London don’t have to impact your credit score. We offer diamond financing without credit checks, making the process faster and more accessible. Your GIA-certified diamonds serve as collateral, simplifying the loan approval process and helping you discreetly generate capital.

When you need quick access to funds, our pawn shop for diamonds, located just off Oxford Street, is here to help. We typically provide same-day payments for loans on diamonds, allowing you to leverage your GIA-certified diamonds and often receive payment in as little as two hours.

Flexibility is crucial when you pawn GIA-certified diamonds. We allow you to repay your loan at any time during the two to seven-month contract period. This gives you the freedom to reclaim your diamonds whenever your financial situation improves, but without paying early termination penalties.

Our diamond financing services are fully regulated by the FCA and NPA. This oversight ensures that when you pawn GIA diamonds with us, you’re engaging in a fair, transparent, and legally compliant transaction that affords you maximum protection on your loan.

5%

fixed interest rate

35+

years experience

40+

industry awards

Regulated by the FCA

The most awarded pawnbroker in the UK

With over 40 prestigious industry awards, a loyal customer base, and flawless reviews, our track record speaks for itself. We retain a customer base of high-net-worth individuals and famous names through competitive interest rates, discretion, trust, and impeccable service.

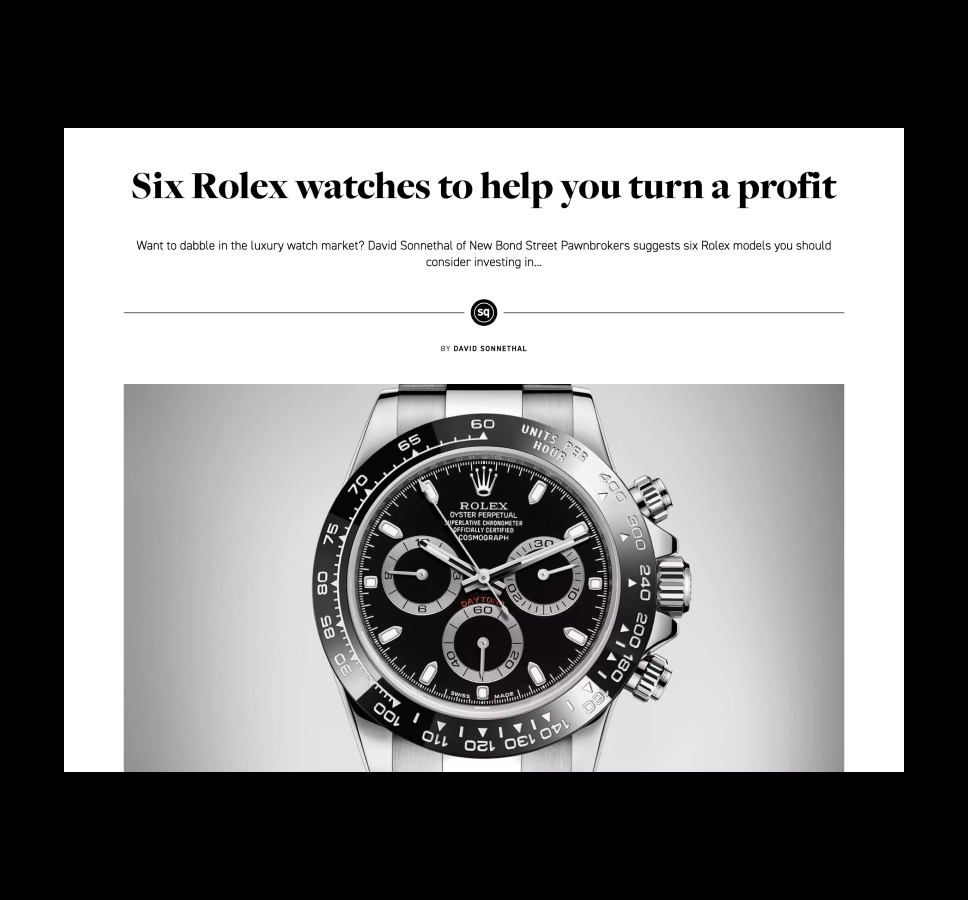

Headed by David Sonnethal, a four-time National Pawnbroker Association (NPA) award winner and familiar media figure, New Bond Street Pawnbrokers’ modern, forward-thinking approach to providing loans has not gone unnoticed by the public, the media, or trusted industry bodies.

Our reputation as an industry leader is cemented by awards that recognise the value that our store brings to customers. We took home the NPA Best Store of the Year award in 2019 and 2024 thanks to our commitment to innovation, adoption of technology, and a strong focus on teamwork. Additionally, the NPA highly commended us in 2022 and 2023 for our engaging social media work, which helped bring us closer to our customers.

New Bond Street Pawnbrokers also won “Best Website” and “Disruptive Business Model” at the UK Business Awards, thanks to our focus on customer-centric digital experiences. Finally, our win at the Experian Credit Awards demonstrates our dedication to responsible lending, customer care, and digital innovation in the luxury pawnbroking sector.

Transparency, fair lending practices, and user-friendly experiences are at the heart of what we do at New Bond Street Pawnbrokers. Reach out today to discover why we’re the most awarded pawn shop in the UK.

How we value your GIA Certified Diamonds

Call us or fill in the form on our website

You can contact us via our website or visit our Mayfair pawn shop. Provide details about your GIA-certified diamonds, including carat weight, cut, colour, and clarity. Our diamond pawnbrokers ensure a seamless process for your valuable gemstones.

Or call 020 7493 0385 to speak with our team

2. Review GIA Certified Diamonds

Our gemologists meticulously examine your diamonds using the Four Cs valuation method. We consider current market trends and overall demand for loose diamonds. This comprehensive review ensures an accurate appraisal for your diamond collateral loan in Central London.

3. Agree Loan Amount

We offer a precise loan amount reflecting your diamond’s Four Cs evaluation. Our Mayfair diamond experts explain how each characteristic impacts the loan value. After ensuring you understand the GIA-based valuation, we finalise the agreement.

4. Receive Payment

Receive prompt payment via bank transfer or cash upon agreement. Your GIA-certified diamonds are stored securely in our West End vaults while you borrow against them. Pay off your loan anytime without incurring an early termination fee.

Featured in the Press

Our quality service, high standards, and innovative business practices have earned positive press coverage from a diverse set of media outlets such as The Times, The Telegraph, Time Out, Channel 4, The Spectator, and more.

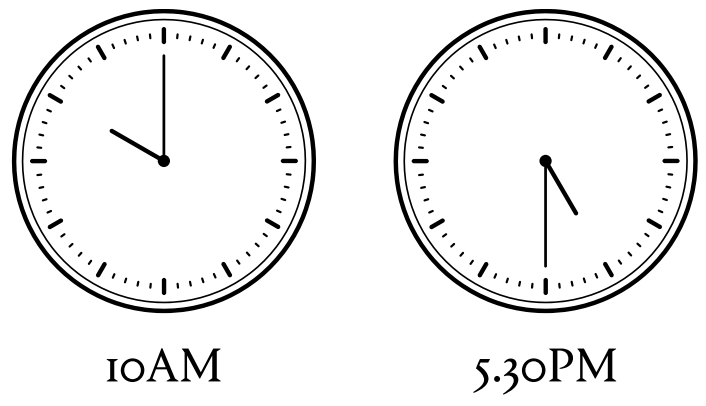

Opening Hours

Open

Monday to Friday

Closed

Saturday & Sunday

Bus

Car

Tube

Our Team

Susana Figueiredo

Manages the day to day running of the business

Mariana Vlad

Manages the day to day running of the business

Constantin Singureanu

Heads up our marketing and digital efforts

David Sonnenthal

The founder of New Bond Street Pawnbrokers

FAQs

Pawning vs. selling your GIA-certified diamonds

Pawning your GIA-certified diamonds with New Bond Street Pawnbrokers in Mayfair offers a flexible alternative to selling. You retain ownership while accessing immediate funds, with the option to reclaim your diamonds upon repaying the loan.

Why do we lend only against GIA diamonds?

We exclusively offer diamond loans in London for GIA-certified diamonds due to their globally recognised standards. This ensures accurate valuation and security for both parties.

How we value your diamond(s) before securing a loan

Our expert GIA diamond pawnbrokers in Mayfair assess your diamonds using the Four Cs: Cut, Clarity, Color, and Carat weight. We also consider current market trends when offering competitive diamond collateral loans.

How much can I pawn your diamonds for?

Loan amounts vary based on your diamond’s characteristics. At our New Bond Street location, we typically offer loans between 50-70% of the diamond’s current market value.

Understanding the 4 Cs and why they matter to determining the value of your diamond

The Four Cs (Cut, Clarity, Color, Carat) are crucial in assessing a diamond’s quality and value. Each factor significantly impacts the loan amount we can offer when you pawn GIA-certified diamonds.

Impact of colour on your diamond's loan value (1st C)

Colour grades range from D (colourless) to Z (light yellow or brown). Higher grades (D-F) typically secure higher loan values when you borrow against certified diamonds.

Impact of carat weight on your diamond's valuation (2nd C)

Carat refers to a diamond’s weight. Larger diamonds are rarer, often commanding higher values per carat when pawning loose diamonds.

Understand the cut of your diamond (3rd C)

Cut affects a diamond’s brilliance and overall appeal. Excellent cuts can significantly increase a diamond’s value when seeking diamond loans in London.

How does the clarity of your Diamond affect borrowing

Clarity grades range from Flawless to Included. Higher clarity grades generally secure better loan terms with our Mayfair diamond pawnbrokers.

I want to pay my loan earlier - will you charge me any penalties?

No, New Bond Street Pawnbrokers encourages early repayment without penalties, allowing you to reclaim your diamonds sooner.

How long can I pawn my diamonds for?

Our standard loan terms are between 2 and 7 months, but they can be extended if necessary. We offer flexible options to suit your circumstances.

What will happen to my diamonds if I don't pay my loan?

If you cannot repay the loan, we may sell your diamonds to recover the borrowed amount. However, we always strive to work with clients to find alternative solutions.

What papers do I need to pawn my diamonds to you?

You’ll need to provide the GIA certificate for your diamonds, proof of ownership, and a valid ID. In some cases, additional documentation may be required.

Will you carry a credit check?

No, we don’t perform credit checks. Your GIA-certified diamonds serve as collateral, making the loan process quicker and more accessible.

Useful Guides

How to get the best price when Pawning your Classic Car

You may have heard the phrase that something is only worth what someone is willing to pay for it. In…

Top 8 Brands of Classic Cars You Can Loan Against at Luxury Pawn Shops

1. ASTON MARTIN Lionel Martin and Robert Bamford are to be thanked for the founding of Aston Martin, way back…

How to get the best price when Pawning your Classic Car

You may have heard the phrase that something is only worth what someone is willing to pay for it. In…

Top 8 Brands of Classic Cars You Can Loan Against at Luxury Pawn Shops

1. ASTON MARTIN Lionel Martin and Robert Bamford are to be thanked for the founding of Aston Martin, way back…